Homes, Hope, and Our Future: America Can't Afford to Leave Millennials Behind

Answering the Call

There’s no real excuse for why a Millennial with a stable income and the desire to buy a home is perpetually locked out of the housing market. Yet, such a reality persists. If this trend continues for much longer, it’ll present a true threat to social and economic stability in this country — and it's not like we as Americans are lacking for explosive social issues to address.

Thus, in this essay, I have taken it upon myself to embark on a crusade to Make America Homeowners Again. My cause is simple. I want every Millennial who can afford to buy a home—and wants to buy a home—to actually to be able to accomplish this goal. For me personally, it's not even necessarily about living up to our parents’ expectations, keeping up with the Joneses, or GDP figures. A viable path to homeownership matters for the country, for our communities, and for the future of our society in many more ways than that.

But, first, take a second to think about what our generation has already lived through: 9/11, many of us watching our parents lose homes during the 2008 meltdown, graduating college just to get smacked in the face with a brutal job market (anyone unfortunate enough to have student loans piling up on top of this feels double the pain), a global pandemic and a couple years of lockdowns. And, finally, here in 2025 we may be the opening shots of WW3. To live through several “once in a lifetime” events, just to get to your 30s and not be able to buy a home, is a cruel joke; especially considering that since at least post-WW2, home ownership has been one of the clearest markers of stability, independence, and upward mobility in America.

Home buying is the only way to demonstrate those things, of course. It's just that within the American psyche, homeownership is a proper, modern right of passage. I've been reflecting on what my parents and grandparents were able to accomplish, and it's depressing to realize that they were way ahead of where I am at the age of 35. I'm certain I'm not the only one who feels this way.

Aside from personal frustration, though, these trends continue to represent a real risk to the stability of our country. Economically, broad access to homeownership spreads wealth, stabilizes neighborhoods, and fuels consumer spending. Socially, it creates tight-knit communities where people have a real stake in their schools, local businesses, and civic life. Politically, generations without access to stability are vulnerable to cynicism, polarization, and disenfranchisement. History is full of examples where entire generations who felt they had nothing to lose became the ones who were perfectly happy to burn it all down.

I refuse to give in and allow that to happen to us without a proper fight. I may not be excited by much, but clearly I’m passionate about this.

The good news is it's not too late! When it comes to strengthening our society through homeownership, we just need to understand why the market is broken, how the rules have changed, and what buying strategies work best for individual situations.

Reality Check

The reality for Millennials is that the path to homeownership looks very different from it did for our Boomers or Gen X parents. We grew up expecting that if we worked hard, saved some money, and built stable careers, we could follow the same playbook our parents did. This meant buying a starter home in our mid-twenties to early thirties and gradually trading up as our incomes grew. Instead, we’ve reached home-buying age in a market defined by underbuilding since 2008 (after many unfinished & abandoned subdivisions builders became gun shy), a post pandemic surge in prices, and mortgage rates that doubled literally overnight.

How We Got Here: 2018–2025

To understand why buying a home for the first time today can feel so hopeless, we need to step back and look at the past seven years. Back in 2018, the housing market was slowly returning to normal after bottoming out around 2012. Prices were rising, the economy was growing, wages were improving modestly, and mortgage rates were around 4–5%; higher than the ultra-low rates of 2020, but still more than manageable, historically speaking. Millennials were reaching their late twenties and early thirties, starting families, and assuming the path our parents had taken—save, buy, trade up—was still viable.

Then 2020 hit.

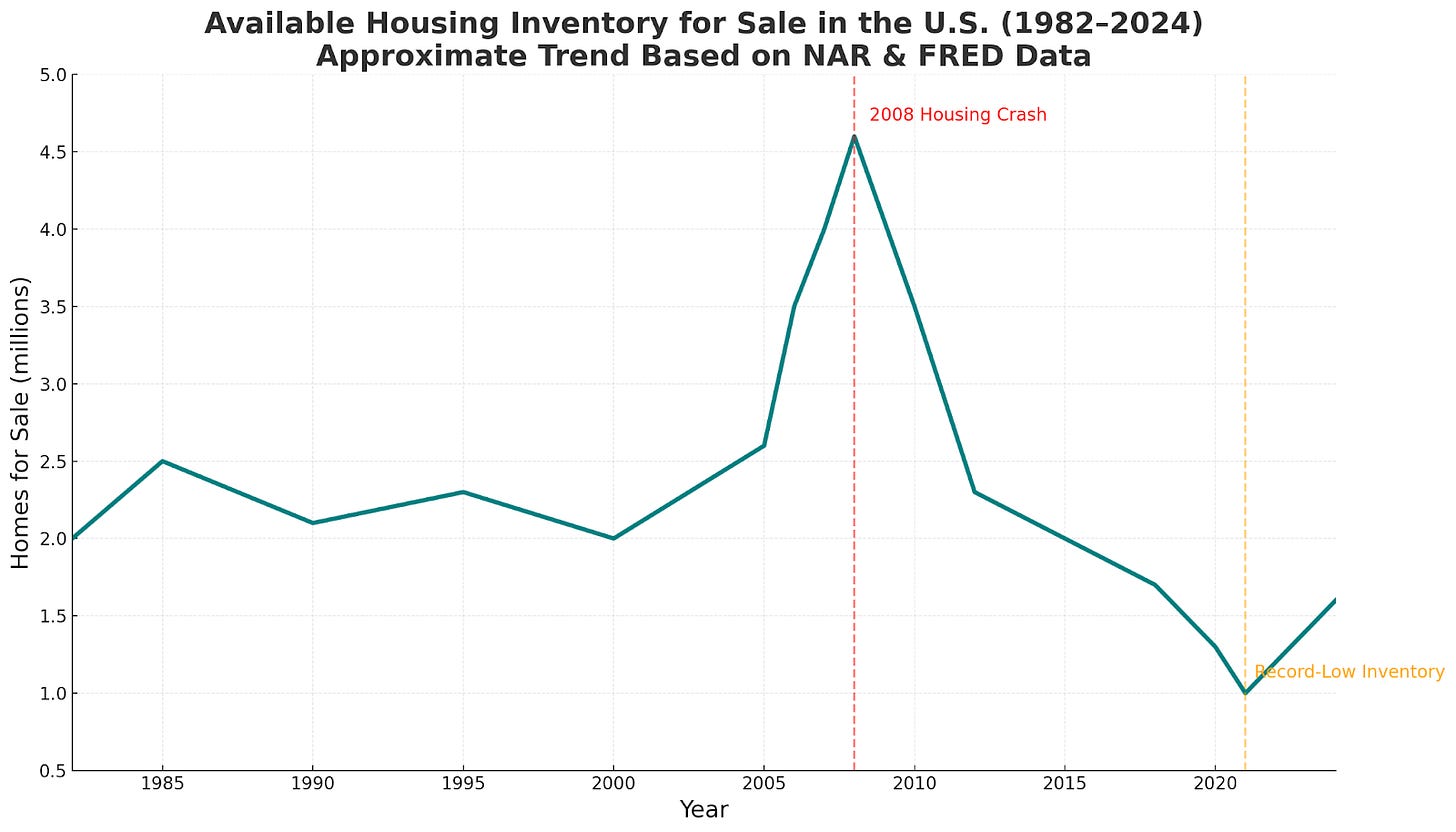

The pandemic turned life upside down, and real estate was not spared. Mortgage rates plummeted to record lows under 3%**, and remote work became widespread, meaning buyers suddenly had more flexibility on where they could live. Following, demand exploded, particularly for larger homes in suburban and Sun Belt markets, and there was nowhere near enough inventory to keep up. Add underbuilding since 2008 to the mix, and the result was that even small demand spikes caused sharp price increases, unlike ever seen.

For many of us, this was the first real shock. The ladder our parents climbed was suddenly much harder to get on. Prices were exploding while wages only increased nominally. In a climate with minimal inventory, the few homes that were available were often snapped up by investors or older buyers who could pay cash. This also resulted in bidding wars for the most desirable homes and locations.

Most of us Millennials watched in disbelief as the insanity of the pandemic years played out. By mid-2022, red hot inflation resulted in mortgage rates hitting nearly 8%! While this isn't high compared to long-term rates, it definitely caused a shock in a market accustomed to 3% rates. This put what many call the “golden handcuffs” on many homeowners, freezing them in place when in a normal market they would have become “move-up” buyers and freed up their previous homes, therefore allowing more buyers to enter the market. Instead, this “rate lock-in” effect kept inventory artificially low, meaning prices stayed high even with increased mortgage rates. Even as rates began easing earlier this year to the mid-6s, the price of a median home remained at all-time highs, and first-time buyers were left with fewer options.

All of this to say, the lesson here is clear: Millennials can’t rely on the same assumptions that worked in the past. The path to homeownership now requires flexibility, creativity, and a clear understanding of the new market dynamics. If you want to break into this market, you need to focus on strategies that maximize purchasing power, leverage any and all available financing tools, and find opportunities where they exist. One thing is certain: waiting for a return to a “normal" that will probably never come is a losing strategy that will literally leave you out in the cold.

Expectations vs. Reality

Growing up, many of us were told, or at least assumed, that buying a home was a perfectly attainable milestone of adulthood. The process seemed simple: save a down payment, get a 30-year mortgage at a reasonable rate, and gradually trade up from a starter home using equity/profit from past home sales. That’s how Boomers and Gen X seemed to do it, and the success of this strategy was confirmed in my eyes as I watched my parents execute it with great success.

I know many of you reading this sentence witnessed this, too!

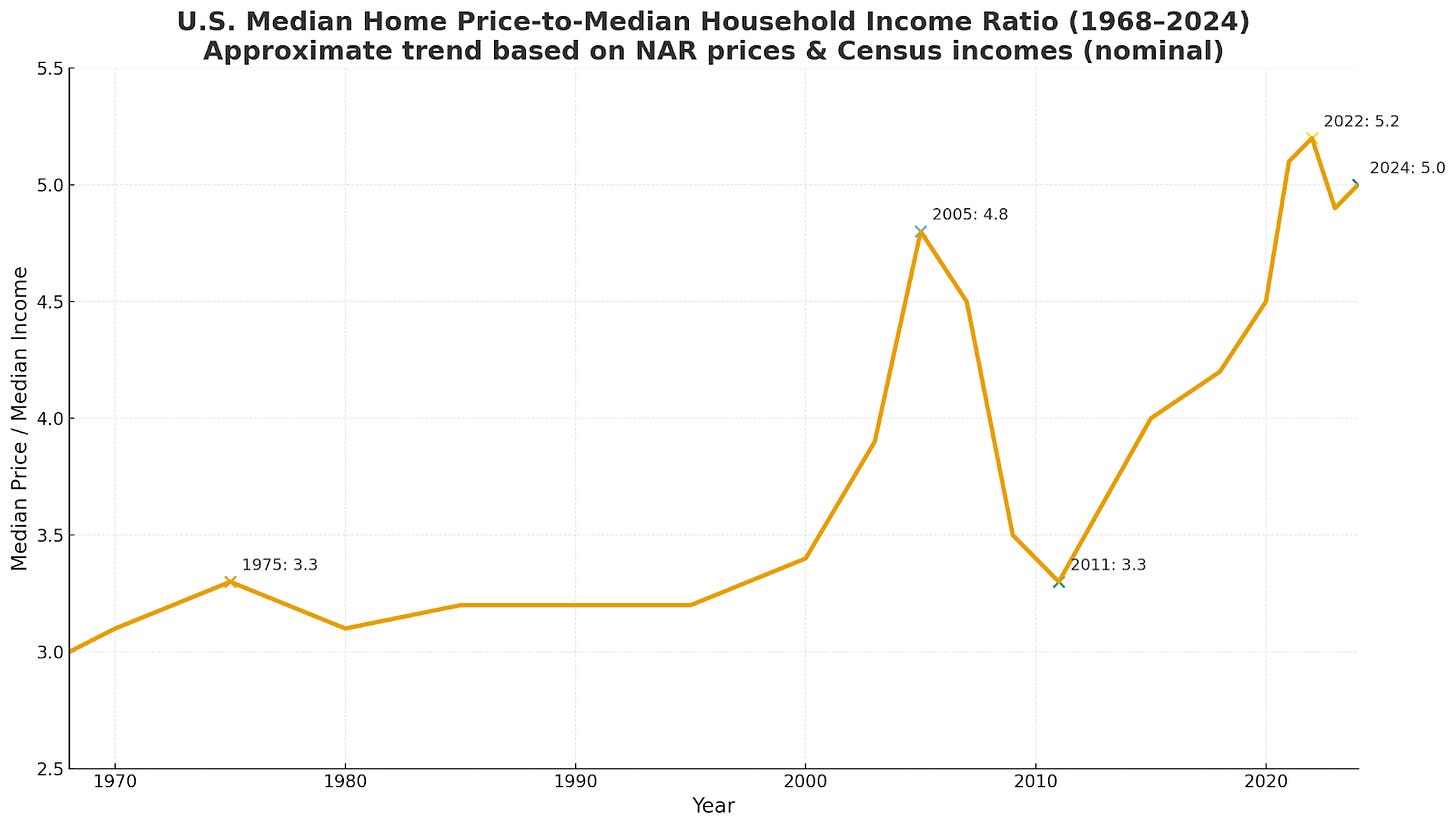

Here's the thing, though: starter homes used to be plentiful, first-time buyers were a significant share of the market, and price-to-income ratios (home price divided by annual income, i.e., affordability) made sense. Refinancing, moving, and upgrading were part of the natural rhythm of life that made much of what we refer to as the American Dream possible.

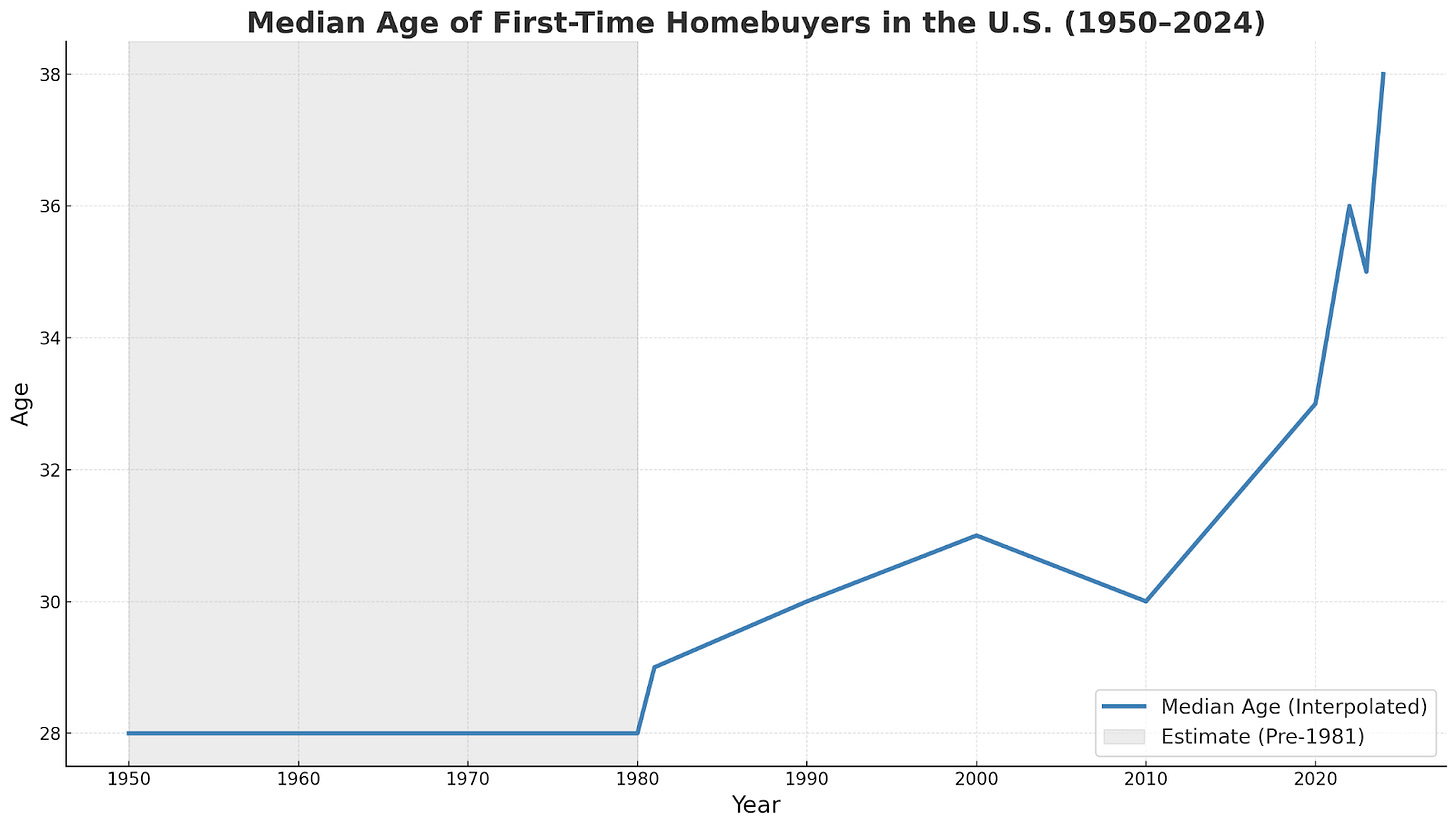

The reality today is drastically different. Entry-level homes are a thing of the past, with a fraction of new construction targeting what used to be the “starter” segment. National price-to-income ratios sit near all-time highs, and even with rates easing from the highs around 8%, monthly payments remain historically high. Cash needed for down payments and closing costs is more than ever before, and the same “golden handcuffs” effect keeps current homeowners from selling, limiting inventory even further. First-time buyers are older on average than they were in the past and represent a smaller slice of transactions than in previous decades.

In short, homeownership is way less attainable than it was just 7 or 8 years ago. Fortunately, while the market has shifted, the door to homeownership hasn't been closed entirely. The key is to understand how the rules have changed and to adapt strategies that allow you to reclaim footing on the property ladder despite higher prices, tighter inventory, and elevated rates.

An Actionable Playbook

The old rules—save 20%, buy a starter, sell and move up—don’t work in today’s market. But that doesn’t mean owning a home is impossible. It just means you need a smarter, more flexible strategy.

I offer below some clear paths to Make America Homeowners Again:

***None of the below is financial advice. These are just ideas and they're not applicable to every situation. If any of these interest you PLEASE run it by an expert with fiduciary duty to you before making any moves***

1) Focus on the payment, not just the price.

Monthly affordability is the real limiter today. Look for ways to reduce your payment: ask sellers for credits to buy down your rate, target homes with assumable FHA or VA loans, or consider multi-unit properties where rental income offsets your mortgage. Just because a property is expensive doesn't mean there's no way for you to afford it.

2) Expand your financing toolkit.

FHA (3.5% down), VA (0% down), USDA (0% down in eligible areas), and Fannie Mae HomeReady (up to 95% LTV on multi-unit homes) are all low down-payment options that are helpful in a high price environment. Stack these options with local down-payment assistance programs to make the cash you need to come up with more manageable.

3) Consider multi-unit and house-hack opportunities.

Buying a duplex, triplex, or fourplex—and living in one unit—lets you use rent from other units to help cover your mortgage. Even a small ADU, casita, garage apartment, or rentable suite can make a huge difference.

4) Grab those incentives from new home builders.

Roughly 60% of builders today are offering rate buydowns, closing-cost credits, and upgrade packages. When you negotiate new construction, it’s often smarter to ask for these payment-reducing incentives rather than a straight price cut.

5) Move with purpose.

Start by setting a tight "buy box"—know the neighborhoods, property types, and price ranges that work for you. Then monitor listings, price drops, and builder incentives closely.

6) Be creative with co-buying or shared equity.

If you have a trusted partner or family member, co-buying with a clear agreement can let you pool resources and enter the market sooner, while still keeping exit strategies and equity splits clear.

The common thread: today’s market rewards flexibility and strategy. By focusing on payment efficiency, leveraging available financing programs, and thinking creatively about property types and incentives, Millennials can reclaim a path to homeownership—even in a market that feels stacked against us.

Homeownership, good or bad, has become much more than just having a place to live. It has become a cornerstone of economic stability, social engagement, and upward mobility. Above all else, as mentioned, a society where young people can afford to buy homes is stronger, more resilient, and more vibrant. It signals that hard work can translate into tangible security, that communities are invested, and that wealth can be built and passed down. Every first-time buyer who succeeds today isn’t just achieving a personal goal—they’re proving that the ladder to upward mobility still exists—and that it’s possible to climb, even when the rungs look a little higher than they used to.

So, if you’re ready, start mapping your path. Learn the tools, track the listings, leverage every available advantage—and claim your space in a market that may feel intimidating, but is still full of opportunity for those who are knowledgeable, have a strategy, and act intentionally.

Excellent article covering one of the most critical problems of our time!

I would note that while rising home prices are a problem anywhere, the severity of the crisis varies greatly by region. The South and Midwest seem to have the most reasonable prices in the current market. While many middle-class professionals might assume that these states have poor cultural amenities, I would recommend that Millennials buy in states such as Iowa, Wisconsin or Michigan, as they have the amenities of much more expensive regions, but prices comparable to the Deep South.

If you enjoy Colorado or the Pacific Northwest, definitely consider Michigan's Upper Peninsula. The home prices are much lower and the natural scenery is comparable.

My data comes from Wikipedia and personal experience. What are your thoughts?

https://en.wikipedia.org/wiki/List_of_U.S._states_by_median_home_price#/media/File:Cost_of_housing_by_State.webp

4a + 6b

Assuming you like your boomer parents, consider finding a builder / developer that focuses on multigenerational homes - they exist!